The Buyt Desk

Delay in loan repayment cannot end up in humiliation. Fintech platforms that are happily doling out loans with offers like no paperwork, no CIBIL, and loans in minutes turn into loan sharks if there is even a single-day delay of repayment by the borrower. They resort to aggressive methods to threaten and blackmail the borrowers. This behaviour is rising since the COVID pandemic, especially by fintech lenders. Fintech is a financial technology that is online and fintech lenders are app-based lending platforms run by either banks or a non-banking financial company (NBFC).

Humiliation by Fintech lenders

Fintech lenders are threatening borrowers with police complaints and issuing legal notices. They humiliate small borrowers who have borrowed as small amount as Rs 10000. During the pandemic, many could not continue paying EMIs. Even the Reserve Bank of India (RBI) had announced a loan moratorium for 6 months during the pandemic. But many Fintech lenders did not consider the loan moratorium and recovery agents threatened borrowers through messages and calls. They not just rejected the request for a moratorium but charged a 1% penalty on the loan amount per day from the due date.

Borrower’s despair

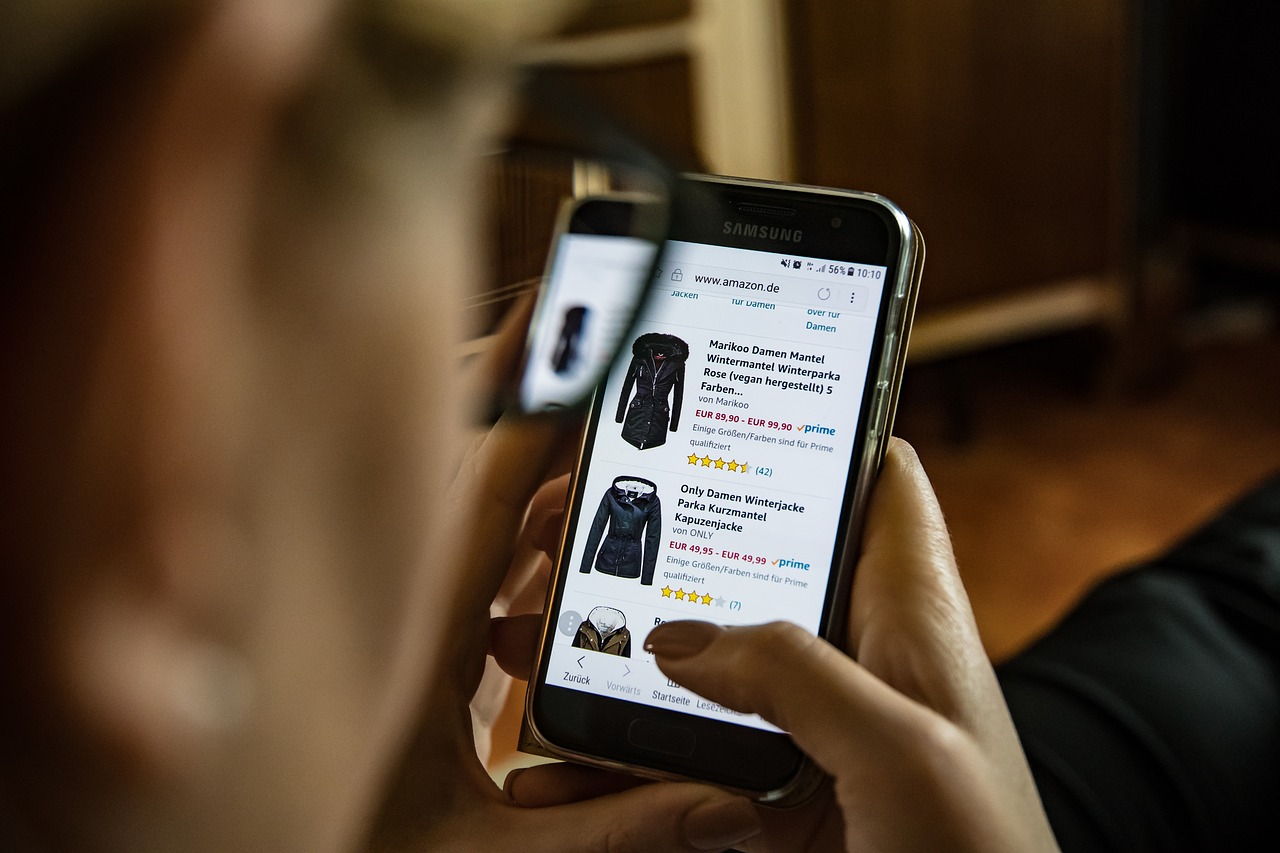

We can see so many stories and reviews on social media that talks about the borrower’s despair. Fintech lenders are charging steep interest rates on the loan amount and charging heavy penalties for delays in the repayment of loans. There have been instances when the borrower’s relatives, neighbours or bosses were called for the recovery of the loan. These apps take permission to access the phone when installing the app. So they have access to the contact list and photo gallery of the phone.

How are Payday loans blown up?

Payday loans are small loans disbursed by mobile apps or online websites and loan amounts can be anything from Rs 1000 to Rs 3 lakh. Usually, salaried people in the age group of 21-35 are the ones who opt for a payday loan. Borrowers can go for payday to pay school fees for their children, medical emergencies or any personal expenses. Even a self-employed borrowers can go for payday loans to meet their business needs. They can borrow for 7 days to 3 months or even for a year. A payday loan is an expensive loan as the interest rates can be anywhere between 25% to 40% a year plus the processing fee is 15 to 20 % and 18 % goods and service tax (GST). And if the borrower delays the EMI then there is a huge penalty to be paid. Though these are expensive loans, these have increased many folds in the last 2 years. Borrowers have increased so are digital lenders and recovery agents.

Digital lenders have a new code of conduct

The Digital Lenders’ Association of India (DLAI) has thrown some light on ethical practices for all its members and has issued a fresh code of conduct. These guidelines indicate lenders to avoid exorbitantly high and non-transparent late payment fees and ask for transparency in pricing. Also asks lenders to fix the late payment fees at the time of giving out the loan and keep the borrower informed about the same. Lenders are asked to not call any family members of borrowers to threaten or harass them.

What are the rights of borrowers?

Borrowers have a right to know about the collection agent. They have the right to privacy and can opt to not discuss their other debts. They have a right to be treated fairly and with dignity. They can file a complaint with the financial institution in case of a grievance. They have the right to take legal action against the lender and file a complaint at the police station in case of harassment. The borrowers can be contacted only from 7 am to 7 pm.

What do lenders do if the borrower defaults?

Lenders can provide a loan moratorium or ask the borrower to restructure the loan so that the borrower will have the flexibility and a simple option to repay the loan. One-time settlement of loan is also an option when the lender offers to waive off interest and penalty charges. In any case, the credit score of the borrower will be affected.